Ehrgeld - CBDC

My newsletter, Bankasız Toplum, was converted into a new version in English to reach a wider audience. This version is called "Ehrgeld" and covers digital assets. In the first one, CBDCs are our case.

CBDC (Central Bank Digital Currency)

CBDC: A Central Bank Digital Currency (CBDC) is a digital version of a country's national currency that is issued and backed by the central bank. CBDCs are designed to function as a medium of exchange, unit of account and store of value, like physical cash or traditional bank deposits. They aim to enhance the efficiency and accessibility of financial services while maintaining the stability and security of the financial system. Some countries are exploring the potential benefits and challenges of CBDCs as a complementary payment system to cash and traditional bank deposits.

Wholesale CBDC: Wholesale CBDC (Central Bank Digital Currency) is a digital currency intended for use in large-value transactions between financial institutions, central banks and other eligible market participants. Unlike retail CBDCs, which are intended for use by general consumers, wholesale CBDCs aim to improve the efficiency and security of cross-border payments and settle large financial transactions in a faster and cheaper manner. Wholesale CBDCs can potentially reduce the dependence on traditional intermediaries, such as correspondent banks, and enhance the speed and transparency of cross-border payments. However, their implementation and use raise several technical, regulatory and policy challenges that need to be addressed before they can be widely adopted.

Programmable: Programmable Wholesale Central Bank Digital Currency (CBDC) is a type of CBDC that is designed specifically for wholesale interbank transactions. Unlike retail CBDCs, which are intended for general public use, programmable wholesale CBDCs are intended to be used between financial institutions for large-value transfers and clearing and settlement purposes. These types of CBDCs can be programmed to automatically enforce specific rules and regulations for financial transactions, reducing the risk of fraud and errors. Programmable wholesale CBDCs are being explored as a means to modernize the existing payment systems and make cross-border transactions faster, more efficient and secure.

Value Based: Value-Based Central Bank Digital Currency (CBDC) is a type of CBDC that is linked to a basket of underlying assets or a specific benchmark, such as a basket of currencies or a commodity price index. The value of the CBDC is designed to remain stable by tracking the underlying assets or benchmark, reducing the risk of price volatility that is associated with cryptocurrencies like Bitcoin. Value-based CBDCs can provide a more stable store of value compared to traditional cryptocurrencies, which are subject to large fluctuations in price. This type of CBDC is being explored as a potential means to facilitate cross-border transactions, settle financial transactions, and provide a safe and stable store of value for individuals and institutions.

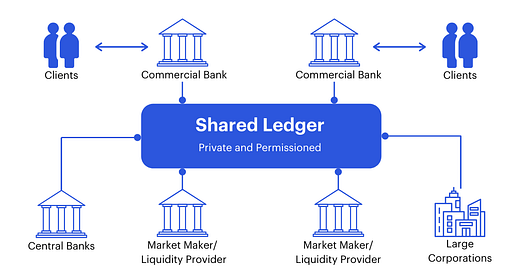

Here is a basic business function of Central Bank Digital Currencies by Consensys:

Retail CBDC: Retail Central Bank Digital Currency (CBDC) is a type of CBDC that is intended for use by the general public, similar to traditional physical cash or bank deposits. Retail CBDCs are designed to be easily accessible and usable for everyday transactions, such as buying goods and services. They aim to enhance the accessibility and efficiency of financial services for individuals and small businesses, and to complement traditional payment methods like cash and bank deposits. The central bank is responsible for issuing and managing the retail CBDC, providing a secure and stable means of payment for individuals and businesses. Retail CBDCs are being explored by some countries as a means to modernize the existing payment systems, enhance financial inclusion, and improve the efficiency and security of payment transactions.

Programmable

Value Based

Account Based: An account-based Retail Central Bank Digital Currency (CBDC) is a type of retail CBDC that is issued and held in digital form on a customer's account with the central bank. The central bank maintains the ledger of CBDC transactions, providing a secure and transparent record of all transactions. Customers can access their CBDC account through a digital wallet or a mobile application, and can use the CBDC to make payments, store value, or transfer funds to other CBDC accounts. The account-based retail CBDC offers a convenient and secure way for individuals and small businesses to access financial services, and can enhance financial inclusion by providing access to digital payments for those who are currently unbanked or underbanked.

I read a well-explained and insightful article written by

from Web3 Labs. The article discussed the concept of a "backdoor CBDC" and provided real-world examples to illustrate how stablecoins can be collateralized and backed by money market funds to overcome regulatory limits and challenges.Key Takeaways

Basically, a backdoor CBDC involves a stablecoin being backed by reserves held by a central bank, without requiring an account with the central bank.

For instance, Blackrock has applied for access to the Federal Reserve's reverse repo facility (RRP) to invest collateral held on behalf of Circle in short-dated U.S. treasuries, which would effectively create a "backdoor CBDC" for USDC holders. This approach circumvents the regulatory challenges faced by other CBDCs, and if approved by the Fed, could raise questions about the need for other types of CBDCs.

Existing synthetic CBDC payment systems tokenise deposits from multiple banks, allowing them to make payments to one another without the constraints of the RTGS system. This process is complex due to regulatory and central bank requirements, so it is unlikely that larger central banks will adopt public blockchain networks in the near future.

USDC is a retail cryptocurrency provided by a commercial entity, not backed by central bank funds, and is likely to be issued by commercial banks in the medium term. However, regardless of the type of digital currency, there will always be issuer risk, and government guarantees may be necessary to protect retail holders.